जी हां दोस्तों! अब आप घर बैठे अपने आधार कार्ड में किसी भी तरह का Aadhaar card Update online uidai डेमोग्राफी सुधार आसानी से करा सकते हैं |

change mobile number in aadhar/ जिसमें आप नाम, जन्मतिथि, लिंग, पता, आधार में दिए हुए लोकल लैंग्वेज,(Name, Date of Birth, Gender, Address and Language Online Update.) जैसी जानकारियों में सुधार होना शुरू हो गया है|

इसके लिए आपको https://ssup.uidai.gov.in/ssup/ के आधिकारिक वेब पोर्टल पर जाना होगा संबंधित जानकारी आपको इस आर्टिकल पोस्ट में विस्तार पूर्वक मिल जाएगी |

आधार कार्ड धारक को आधार कार्ड में संशोधन, change name in aadhar card को लेकर हो रही समस्याओं को मद्देनजर रखते हुए Unique Identification Authority of India, www.uidai.gov.in aadhar correction ने इस बड़े कदम को उठाया है |

अगर आपके भी आधार कार्ड में मोबाइल नंबर दर्ज है और वह मोबाइल आपके पास है तो आप भी घर बैठे अपने Demography details in Aadhar card Update Online और पत्ते/how to change address in aadhar, के संबंधित कोई भी जानकारी को अपडेट करा सकते हैं |

Adhaar card uidai, date of birth correction in Aadhaar card

यहां आपको यह जानकारी स्पष्ट रूप से मालूम हो जाएगी कि आप Adhaar Card में जन्मतिथि केवल पूरे जीवन में एक बार सुधार करवा सकते हैं | (You can change the date of birth in your “Aadhaar card Data” only once in a lifetime. )| इसके अलावा और कौन-कौन सी जानकारियां कितनी बार सुधार की जा सकती है |

नीचे निम्नलिखित रूप में दी हुई है अवश्य देखें! कृपया किसी भी डेमोग्राफी (Demography details–Name, Date of Birth, Gender, Address and Language Online Update.) में सुधार करवाने से पहले कितनी बार सुधार कराया जा सकता है| यह अवश्य जांच कर ले |

-

CSC UCL Aadhaar Center Start | CSC VLE UCL aadhar software big Update 2022

-

“invalid supervisor” CSC Adhaar UCL uidai blacklist 450 operator,

-

Aadhaar PVC Print : UIDAI PVC Print, print PVC Adhar card order 2022

-

Download Aadhar enrollment and correction form, aadhaar update form,

Adhaar card Sanshodhan | We want you to be aware that you can update your Adhaar Card :

how to change registered mobile number in aadhar card, change phone number in aadhar card, aadhar card date of birth change, ssup, aadhar updation form

- नाम – जीवन काल में दो बार /Name – Twice in life time

- जन्म तिथि – जीवन समय में एक बार

- Date of Birth –

- Once in life time

- लिंग – जीवन समय में एक बार

- Gender – Once in life time

यदि परिवर्तन मामूली है और इसमें शामिल हैं, तो आप अपना नाम अपडेट कर सकते हैं:

You can update your name if the change is minor and includes :

modification in the Aadhaar card?

अगर आप के आधार कार्ड में नाम, name change in aadhar card में किसी भी तरह का स्पेलिंग मिस्टेक है सुधार कर सकते हैं शॉर्ट फॉर्म में सुधार कर सकते हैं अगर शादी के पहले आप का नाम बदला है तो सुधार कर सकते हैं नाम बोलने में सुधार चाहते हैं तो कर सकते हैं | how to correct name in aadhar, इसके अलावा संबंधित जानकारी आप यूआईडी के ऑफिशियल वेबसाइट से अवश्य ले लें |

You can update your name if the change is minor and includes :

- Spell correction phonetically same

- Changes in the Sequence

- Short-form to full form

- Name change after marriage, name change in aadhar

आपको अपना नाम, जन्म तिथि और पता सही करने या अपडेट करने के लिए वैध दस्तावेज़ प्रमाण प्रस्तुत करना आवश्यक है। मोबाइल नंबर या ईमेल अपडेट करने के लिए कोई दस्तावेज जमा करने की आवश्यकता नहीं है।

यहां ध्यान दें- हालाँकि, अद्यतन अनुरोध सबमिट करने से पहले नया मोबाइल नंबर या ईमेल ओटीपी प्रमाणीकरण के अधीन होगा। आप अपने पत्ते में महीने में एक बार सुधार करवा सकते हैं |

Aadhaar Card uidai portal update Documents required

Aadhaar Card uidai portal update आधार कार्ड में किसी भी तरह का संशोधन करवाने से पहले आपको आवश्यक डाक्यूमेंट्स स्कैनिंग करके रखने होंगे| वैसे तू आवश्यक डाक्यूमेंट्स की लिस्ट बहुत लंबी है लिस्ट देखने के लिए लिंक पर क्लिक करें

- पैन कार्ड

- पासपोर्ट

- दसवीं की मार्कशीट

- वोटर आईडी कार्ड

- बिजली का बिल

- बैंक पासबुक

- पोस्ट ऑफिस

- अकाउंट स्टेटमेंट

- राशन कार्ड

- ड्राइविंग लाइसेंस

- नरेगा जॉब कार्ड

- फ्रीडम फाइटर कार्ड

- किसान पासबुक

Aadhar card online correction update |आधार कार्ड में ऑनलाइन संशोधन करना सीखें

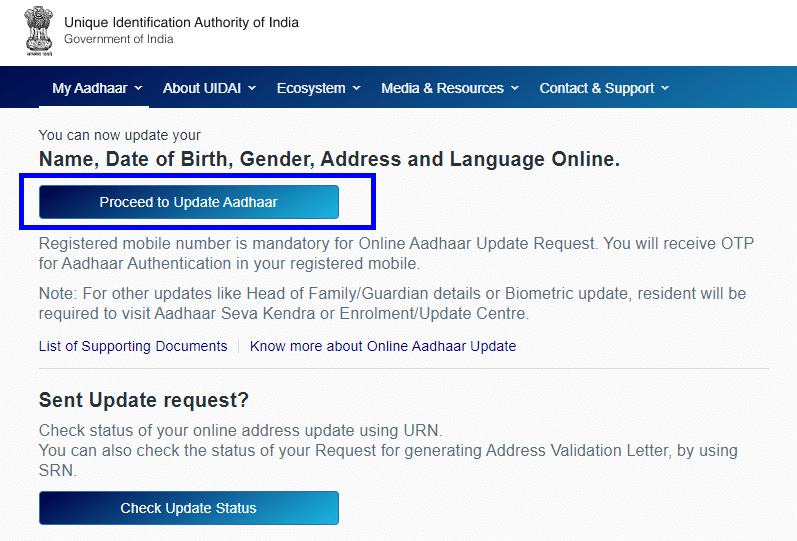

सर्वप्रथम आप UIDAI के द्वारा जारी Aadhar card online correction update/ Aadhaar Self Service Update Portal के ऑफिशियल पोर्टल पर आपको आना है |

- Aadhar card online update portal Website link.-https://ssup.uidai.gov.in/ssup/

- आधार कार्ड अपडेट पोर्टल पर आने के उपरांत आपको दो लिंक दिखाई देगा |

- पहला है “process to update Aadhar” वहीं दूसरा लिंक आपको दिखाई देगा |

- “check Aadhar update status” आपको प्रोसेस टू अपडेट आधार पर क्लिक करके आगे बढ़ना है |

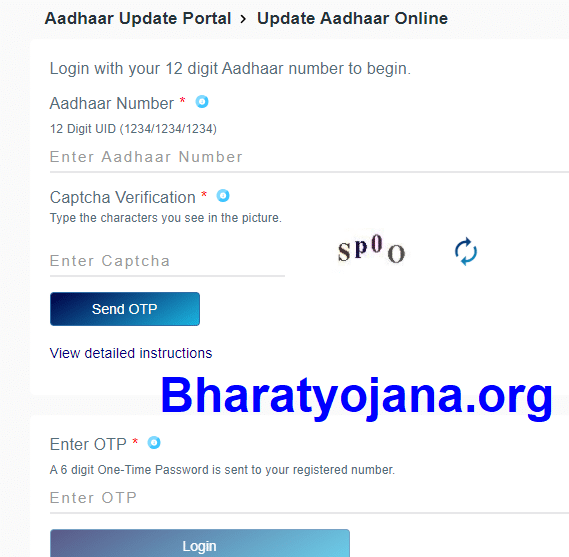

- इस वेब पेज में आपको अपना 12 अंकों का आधार नंबर तथा कैप्चा कोड टाइप करके|

- “Send OTP” पर क्लिक करना है |

- आपके रजिस्टर मोबाइल नंबर पर एक वन टाइम पासवर्ड जाएगा |

- आपको वन टाइम पासवर्ड इंटर करके लॉगइन बटन को प्रेस करना है |

- और अगले चरण की तरफ बढ़ना है |

Adhar card Update online uidai

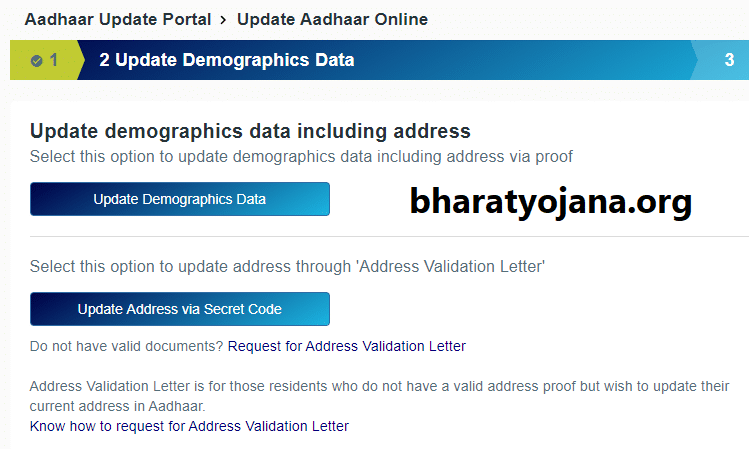

- इस पेज में आपको दो चरण दिखाई देंगे |

- अगर आपको अपने Demographic data correction in Aadhar card करना हो तो अपडेट डेमोग्राफी डाटा पर क्लिक करें|

- अन्यथा अगर आप अपने aadhaar card update online, आधार कार्ड में पते का सुधार करना चाहते हैं |

- सीक्रेट कोड के साथ तो नीचे वाले ऑप्शन का चयन करेंगे और आगे बढ़ेंगे |

- लेकिन इस आर्टिकल पोस्ट में मैं आप लोगों को aadhaar card Sanshodhan, आधार कार्ड डेमोग्राफी अपडेट कैसे करना है|

- यह जानकारी देने वाला हूं तो इसलिए मैं यहां पर आधार डेमोग्राफी अपडेट पर क्लिक करूंगा |

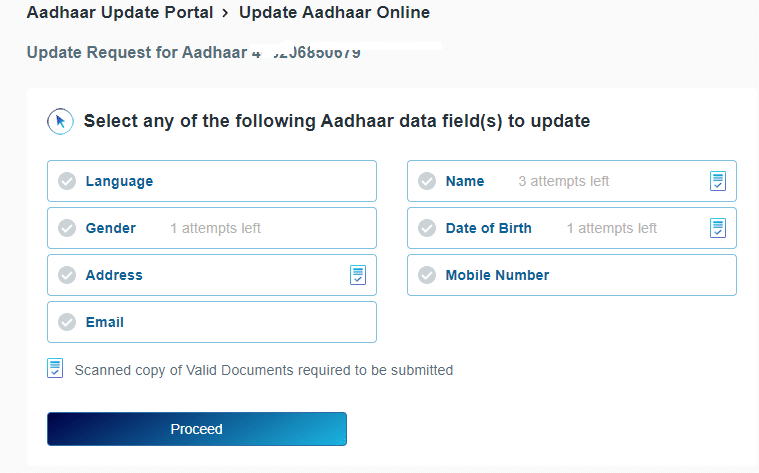

- आपके Adhaar Card Sudhar में कौन सी जानकारी गलत है |

- उसके अनुसार आप यहां पर सिलेक्ट करके जानकारी को सुधार कर सकते हैं |

- जैसे कि आपका लोकल लैंग्वेज, धारक का नाम, जन्मतिथि, पूरा पता, ईमेल आईडी, मोबाइल नंबर, Adhaar Holder Name, Date of Birth, Full Address, Email ID, Mobile Number.

- आप एक बार में कुछ ही जानकारी को सुधार कर पाएंगे |

- तो पहले यहां पर आप यह तय कर लीजिए कि आपको कौन सी जानकारी में संशोधन करना है|

- उसके बाद आप प्रोसेस बटन पर क्लिक करके आगे बढ़ेंगे |

- Proses बटन पर क्लिक करते ही आपके सामने एक पॉपअप खुलकर आएगा |

- जहां आप अपने आधार कार्ड में कौन सी जानकारी को कितनी बार संशोधित कर सकते हैं |

- दिखाई देगी यहां जो भी जानकारी आपको बताई जा रही है उस जानकारी को सावधानी पूर्वक अवश्य पढ़ें अन्यथा बाद में आपको बहुत ज्यादा दिक्कत हो सकती है |

Adhar card Update online uidai

- अब आप अपने द्वारा चुनाव किए गए विवरण में सफलतापूर्वक संशोधित करें |

- संशोधन करने के उपरांत आप वैलिड डॉक्युमेंट्स को अपलोड करें |

- अपलोड करने के बाद आप सम्मिट करेंगे | how to change aadhar card address online,

- आपको ₹50 का ऑनलाइन मोड में पेमेंट करना होगा |

- जिसे आप डेबिट कार्ड, क्रेडिट कार्ड, इंटरनेट बैंकिंग, की मदद से कर सकते हैं|

- पेमेंट सफलतापूर्वक होने के उपरांत आपको एक आधार कार्ड अपडेट के संबंधित रसीद प्राप्त होगी|

- इस रसीद का प्रिंटआउट लेकर आप रख लें ताकि भविष्य में आधार कार्ड में संशोधन हुआ या नहीं हुआ संबंधित जानकारी ऑनलाइन रूप से जांच कर सकते हैं |

दोस्तों यह जानकारी कैसी लगी ब्लॉग पोस्ट के माध्यम से कमेंट करके जरूर बताएं इसके अलावा Adhar card me Nam Sudhar के संबंधित आपके मन में कोई भी सवाल हो तो आप कमेंट के माध्यम से पूछ सकते हैं gadgetsupdateshindi.com को पढ़ने के लिए धन्यवाद|

Note: – If you want all the readers to get the information related to any government scheme, Aadhar card, PAN card or Common Service Center related to the state government or central government like this! So connect through the social media given below and also follow the notification given in the web site gadgetsupdateshindi.com .

अगर आपको यह Adhar card Update online uidai : Change Name, DOB, Gender, Address, 2022 पोस्ट पसंद आया है! तो इसे Like और share जरूर करें ।

इस पोस्ट को अंत तक पढ़ने के लिए धन्यवाद….

Posted by Jeet Jaiswal

❤️ Join Our Group For All Information And Update, Also Follow Me For Latest Information ️❤️

| ❤️ Follow US On Google News | Click Here |

| ❤️ Whatsapp Group Join Now | Click Here |

| ❤️ Facebook Page | Click Here |

| Click Here | |

| ❤️ Telegram Channel Gadgets Updates Hindi | Click Here |

| ❤️ Telegram Channel Sarkari Yojana | Click Here |

| Click Here | |

| ❤️ Website | Click Here |

FAQ Adhar card Update online uidair card Sanshodhan Update

Is it possible to amend Aadhaar without mobile number register?

No, you cannot make any kind of modification in the mobile number Aadhaar card without registering, for this you have to go to the nearest Aadhaar card center.

How much money does it take to make an Aadhar card online improvement.

You have to spend ₹ 50 for the correction of any information in your Aadhar card such as address correction or demography correction, such as name birth date, gender, which has to be submitted in the online mood.

How long does it take to make Aadhar card online correction.

If you are improving your Aadhaar data online through the official website of UIDAI, you may take at least 1 week.

How often can an Aadhaar card user get his date of birth amended?

Any Aadhaar card holder can amend his date of birth only once in his life. You can get the relevant information from the official website of UIDAI.

How many times the Aadhar card holder can get his address correction.

Any Aadhaar card holder can get her Aadhaar card corrected once in a month.

How many times can the holder get the Aadhaar card correction in his name.

You can get your name modified in the Aadhaar card only once in your entire life.

How to Update your Aadhaar card online.

To aadhaar card update online, go to the official web portal of UIDAI and follow the guidelines given, and amend your Aadhaar card online, apart from this you will get detailed information in this article post.

We stumbled over here by a different website and thought I might check things out.

I like what I see so now i’m following you.

Look forward to looking into youhr web page yet again.